AUDJPY – Bullish Structure Aligning for Next Leg Higher

- John Nwatu MSTA CFTe

- Sep 10, 2025

- 2 min read

📈 Quick Overview

📊 Bias: Bullish

🎯 Signal: Entry @ AUD 97.40 – Targeting AUD 102

📉 Invalidation: Break below AUD 96.30

🧭 Setup Structure: Daily & Weekly bullish alignment with Elliott Wave impulse

Technical Picture

AUDJPY is showing promising strength across both the daily and weekly charts. Price remains in a clear upward trend trajectory, with the pair now threatening to break through recent highs which suggests a potential continuation of the larger bullish cycle.

Momentum remains strong without any major overbought signal on RSI and the 50 and 100 week EMAs acting as potential support, indicates there may still be room for upside expansion.

On the weekly chart the 3-wave corrective decline between July 2024 and April 2025 may have already completed, potentially marking the beginning of Wave 5 of the primary degree.

On the daily chart, the recent pullback fits neatly as a Wave 4 retracement, pointing to the next leg higher: a possible Wave 5 impulse of the minor degree.

This dual-wave structure across timeframes strengthens the bullish case.

Correlations to Watch

Two macro correlations may be reinforcing the bullish narrative:

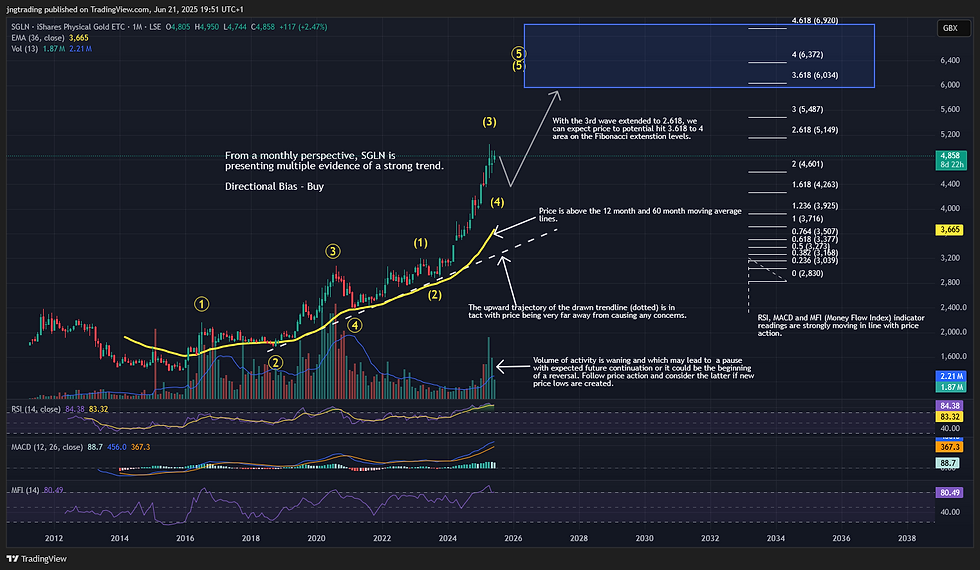

1. Gold ↔ AUDJPY

Since 25th August, there has been a noticeable correlation between Gold’s price and AUDJPY. As gold has rallied, so has the Aussie which isn’t surprising given Australia’s status as a major gold exporter.

2. Risk-On Dynamics & Rate Cuts

AUDJPY is often seen as a risk-on / risk-off barometer. Should the Federal Reserve begin cutting interest rates, this could trigger another leg higher in risk-sensitive assets with the expectation that AUDJPY is likely to benefit from.

Trade Setup

✅ Entry: AUD 97.40

🎯 Target: AUD 102

⛔ Stop Loss / Invalidation: Below AUD 96.30 (start of the initial impulse wave)

⚖️ Risk-Reward Profile: 1:4 Well-structured breakout continuation with clear invalidation

Summary

AUDJPY is one of the cleaner technical setups across FX right now. With structural support from Elliott Wave alignment, supportive macro tailwinds, and bullish momentum on its side, this pair may soon test and surpass its recent highs.

For more FX and ETF setups built on wave structure, trend logic, and real-world context, subscribe to the Trends x Waves Weekly.

Comments