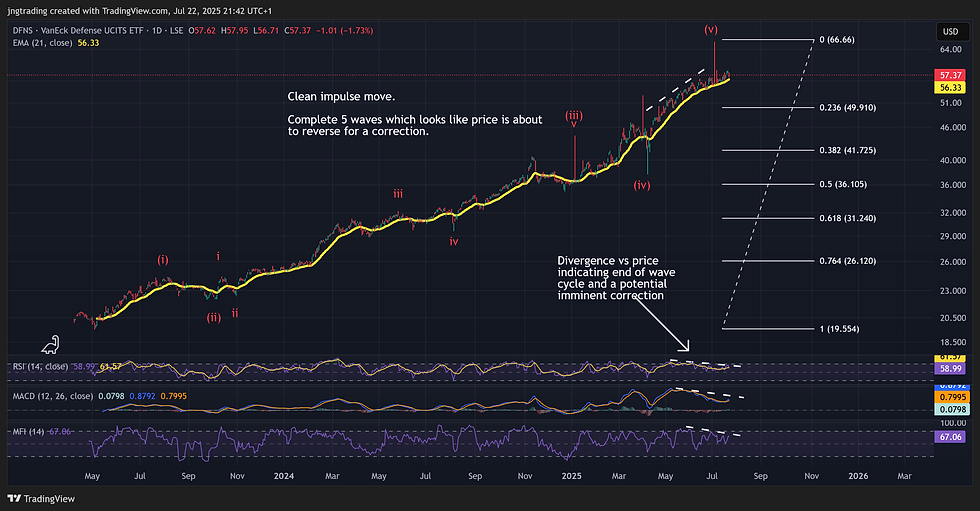

DFNS – Has the Trend Topped? Why It’s Too Early to Buy the Defence ETF

- John Nwatu MSTA CFTe

- Jul 22, 2025

- 2 min read

Updated: Jul 23, 2025

📦 Quick Overview

📈 Bias: Neutral to Bearish (short-term)

🎯 Signal: Watch Only

🧭 Why: Likely completed a 5-wave advance — expecting a correction

⏳ Timing Zone: Watching £41–£35 for buy setup unless price breaks above £66

Macro View: The Case for Defence

DFNS, the iShares UK Defence ETF, has long-term appeal. Most governments consistently allocate ~2% of GDP to defence, making it a resilient sector through both booms and busts.

But while the fundamentals are strong, the chart is flashing caution.

📊 Chart Breakdown

According to Elliott Wave analysis, DFNS appears to have completed a 5-wave impulsive structure, often marking the end of a major leg up. Here’s what I’m seeing:

🌊 Wave Count: Full 5-wave structure completed

📉 Expected Retracement: £41 to £35 — aligns with 38.2% to 50% Fibonacci retracement

⚠️ Invalidation Zone: Close above £66 would negate this bearish bias

⛔ Current Phase: Transitioning from impulsive to corrective

🧠 Tactical Bias: Stand aside — wait for cleaner opportunity

📷 Chart Reference:

📝 Action Plan

⛔ Avoid Buying Now

Price looks extended after the 5-wave move.

There’s no edge in buying near potential exhaustion zones.

✅ Watch for These Conditions:

If DFNS retraces to the £41–£35 zone and holds, I’ll reassess for a bullish entry.

If DFNS breaks above £66 and holds, I’ll flip bias to bullish continuation.

🎯 Trade Strategy Summary:

Entry Zone: £41–£35 (watch for setup)

Invalidation: Close above £66 = rethink bias

🌀 Pro Insight: Timing Is an Edge

Even great ideas need great timing. This setup reflects a common Elliott Wave principle: after a 5-wave trend comes a 3-wave correction (A-B-C). Retail investors often buy the top of Wave 5 — but we’re not here to chase. We’re here to wait, watch, and enter with conviction when the structure supports it.

👤 My Position

I’m currently on the sidelines.

Watching for potential buy signals near the £41–£35 range.

If price closes above £66, I’ll reassess and consider momentum re-entry.

🔚 Final Word

The defence sector is structurally strong. But DFNS looks like it’s already priced in a lot of optimism.

🕰️ Now is not the time to buy — it’s the time to stay patient and prepare.

📩 Like this kind of insight?

📬 Subscribe to the Trends x Waves WeeklyEvery week I break down mid-to-long term ETF setups with actionable approach.

💬 Got thoughts or charts to share? Drop them in the comments.

Comments