Is the US Dollar Going Down? - DXY Analysis

- John Nwatu MSTA CFTe

- Dec 17, 2025

- 2 min read

📦 Quick Overview

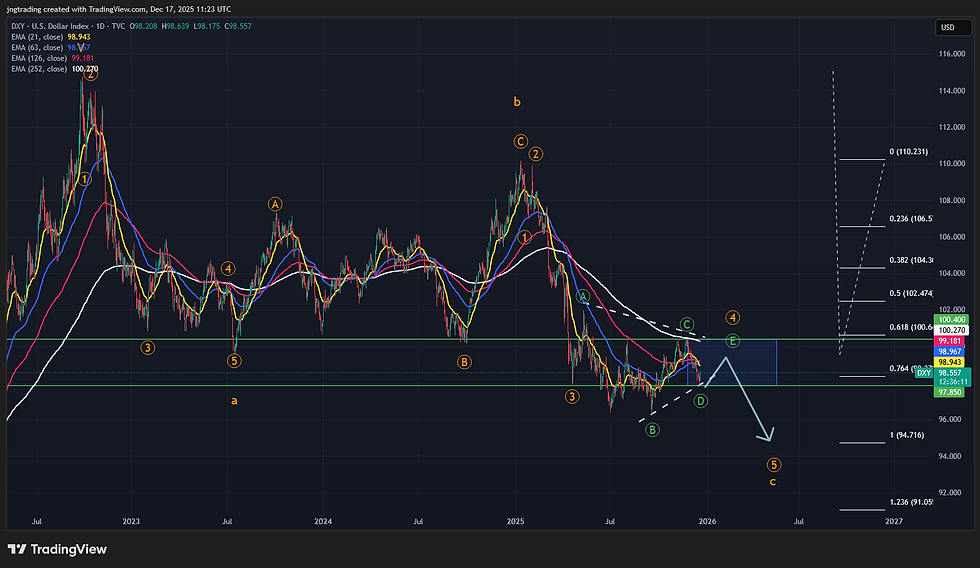

📊 Market: US Dollar Index (DXY)

🧭 Bias: Neutral → Bearish (until proven otherwise)

📉 Structure: Corrective, choppy, range-bound

⚠️ Drivers: Upcoming inflation data + thinning holiday liquidity

🎯 Plan: Wait for range resolution before committing

🧠 Market Context: Uncertainty Dominates

There is growing uncertainty around the US Dollar with inflation data due for release and the holiday season approaching, a period that often sees reduced market participation and thinner liquidity.

These conditions typically lead to choppy, low-conviction price action — and that’s what we’re seeing in the dollar right now.

📉 Price Action: No Clear Direction in the US Dollar

At present, DXY shows no definitive directional bias. Price movements remain overlapping and indecisive, making it difficult to extract a clean trend signal.

From an Elliott Wave perspective, this type of behaviour strongly suggests we are still in a corrective phase. In such environments, sharp or sudden moves often fail and reverse, which makes chasing short-term direction risky.

📊 Trade Plan: Let the Range Decide

Rather than forcing a view, the strategy is straightforward:👉 wait for a clear breakout from the current range box to signal the next higher-timeframe move.

Two scenarios remain in play:

📉 Scenario 1: Downside Break – Trend Continuation (Favoured)

🖼️ Chart:

A break to the downside would indicate the triangle formation is complete, opening the door for another leg lower in the broader downtrend that began earlier in the year.

This scenario is supported by:

Prolonged price contraction

Overlapping corrective structure

Typical behaviour following an initial impulsive decline

This remains my preferred outcome at this stage.

📈 Scenario 2: Upside Break – Impulsive Move Higher

🖼️ Chart:

Alternatively, a break to the upside could signal the start of an impulsive move higher in the dollar. Even if this does not evolve into a longer-term trend reversal, it could still offer a tradable short-term opportunity.

A sustained move above 100.40 would be the key level that forces a reassessment of bearish expectations.

🧠 My Current View

I continue to favour the downside, primarily because price has been contracting for several months following the initial downtrend from January — behaviour that more often precedes trend continuation rather than reversal.

That said, flexibility is essential. If price breaks decisively above 100.40, I’m prepared to adapt quickly and trade what the market presents.

📬 Updates will follow as the dollar reveals its next phase — via Trends x Waves Weekly.

![📊 Weekly Market Update & Outlook – Bitcoin [BTCUSD]](https://static.wixstatic.com/media/f57566_2e456814183a4cb0986a877c61281a22~mv2.png/v1/fill/w_980,h_562,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/f57566_2e456814183a4cb0986a877c61281a22~mv2.png)

Comments